Facts About Qld Estate Lawyers Revealed

Table of ContentsThe smart Trick of Will Dispute Lawyers Brisbane That Nobody is DiscussingThe Facts About Probate Lawyers Brisbane RevealedThe Qld Estate Lawyers StatementsSome Ideas on Probate Lawyers Brisbane You Should KnowProbate Lawyers Brisbane - The FactsWill Dispute Lawyers Brisbane Things To Know Before You Get This

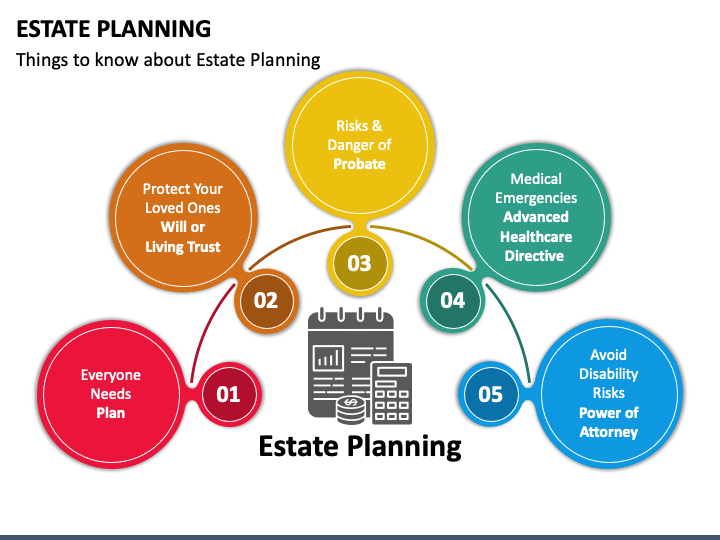

Assessing the domicile and residency of a person at the time of their fatality is crucial for the capability of the estate plan. Individuals can cement the fulfillment of their wishes after their death by coming close to lawful counsel to embrace a Last Will as well as Testimony, which satisfies the requirements of the United States and also any kind of other international nation to promote the circulation of their estate.Some countries, such as the U.K. and New Zealand, might impose entrance and also exit tax obligation on trust fund properties, while others (mainly European nations) do not recognize trusts due to their meaning and also structure of laws surrounding inheritance (common legislation vs.

Probate Lawyers Brisbane - The Facts

transfer tax obligations can be used to a united state person regardless of where they are staying, the location of gifts residential property, or if they have died. United state deportees are entitled to gain from revenue tax alleviation in the form of foreign-earned earnings exemption considering that there is no such advantage where transfer tax obligations are worried.

As a typical regulation nation, the united state enables people extra control and discernment in terms of dispersing their wealth to their successors. This is done by preparing a legal Will that gives details guidelines for the bequeathing of their riches utilizing the probate system. Depends on can be utilized as cars to bypass probate and to avoid/defer estate tax (estate lawyers brisbane).

If a legitimate Will is not in location, state intestacy legislations will certainly determine how the decedent's property should be distributed. As a result of the essential distinctions in typical and also civil regulation countries, it is possible for the existing estate strategy that the family members might have in area to come to be outdated, inadequate, and also probably extremely counter-productive.

Not known Incorrect Statements About Estate Lawyers Brisbane

Along with cross-border taxes as well as laws, another critical variable in any type of international estate preparation process is exactly how one's residency, citizenship, or domicile. These principles have vital value in identifying the transfer tax obligations to which the people can be revealed. Expats require to understand any kind of needs and also definitions under the regulations of the countries where they live, work, and also own properties.

Allow's likewise differentiate that a United state citizen is always taken into consideration a resident for earnings tax obligation objectives. Transfer tax obligations, nevertheless, do not think about the person's tax residency.

Must the specific meet the demands to be considered as a tax obligation resident in the U.S. however does not have the purpose to remain in the country completely, an abode has actually not been created. When residence has actually been developed in a nation, the only method to cut it would certainly be really to relocate outside the country/emigrate.

The transfer tax obligation effects for deportees and also various other non-US individual's home will certainly depend on the following: The character as well as nature of the possessions; The physical place of the possessions; Whether there is an estate tax treaty between the country of domicile/citizenship or residence and the U.S.; Whether there are any tax obligation credit scores offered in the U.S

Federal estate taxes are levied on the worldwide possessions of United state people and homeowners. It is possible for a property to be thought about a non-situs property for United state present taxes but may be considered to be a situs possession for U.S. estate taxes.

The treaty might supply a meaningful decrease in estate taxes using mitigating discriminatory tax treatments and also dual taxation. The treaty figures out the nation of the donor/decedent's abode and also the nation where the residential property is considered to be located. As soon as this decision has actually been made, the treaty controls try this web-site which nations can evaluate transfer taxes.

Estate Lawyers Brisbane - Truths

e., as quickly as the specific ends up being a green card owner, they are deemed to be a united state tax citizen. Allow's additionally differentiate that an U.S. person is always taken into consideration a resident for income tax obligation purposes. Transfer tax obligations, however, do rule out the individual's tax residency. Rather, it will certainly focus on the concept of residence.

Ought to the specific fulfill the needs to be considered a tax obligation homeowner in the U.S. but does not have the intent to stay in the nation completely, a domicile has not been created. Nevertheless, when abode has been developed in a country, the only means to cut it would be actually to move outside the country/emigrate.

completely. Asena Advisors concentrates on tactical recommendations that establishes us besides the majority of wide range monitoring organizations. We protect wealth. Currently that we have actually looked at basic vital details and also concerns to be familiar with allow's study methods, debts, and also various other policies surrounding global taxation for IEP. The transfer tax obligation effects for deportees as well as other non-US person's residential or commercial property will depend upon the following: The character and nature of the properties; The physical place of the possessions; Whether there is an estate tax treaty in between the nation of domicile/citizenship or home and the united state; Whether there are any type of tax credit ratings available in the united state

As gone over above, situs is the Latin word for "position" or "website." In legal terminology, it describes the residential property's location. Government estate tax obligations are levied on the globally possessions of U.S. residents and residents. For non-residents, the see page situs policy is that any type of tangible possession physically situated in the U.S

Examine This Report on Estate Lawyers Brisbane

The regulations for intangible building and also assets are extra made complex. It is possible for a property to be taken into consideration a non-situs possession for U.S. present taxes but may be thought about website link to be a situs possession for U.S. estate taxes. The U.S. currently has estate as well as present tax obligation treaties with fifteen various other jurisdictions.

The treaty might give a meaningful reduction in estate taxes utilizing mitigating inequitable tax obligation therapies and also dual taxes. The treaty determines the country of the donor/decedent's domicile and the country where the home is considered to be located. When this decision has been made, the treaty controls which countries can evaluate transfer taxes.